- Account for stock options in quicken for mac 2007 how to#

- Account for stock options in quicken for mac 2007 Pc#

- Account for stock options in quicken for mac 2007 free#

- Account for stock options in quicken for mac 2007 windows#

Who would buy this? Also, they don't have this information right on the front screen.

Account for stock options in quicken for mac 2007 Pc#

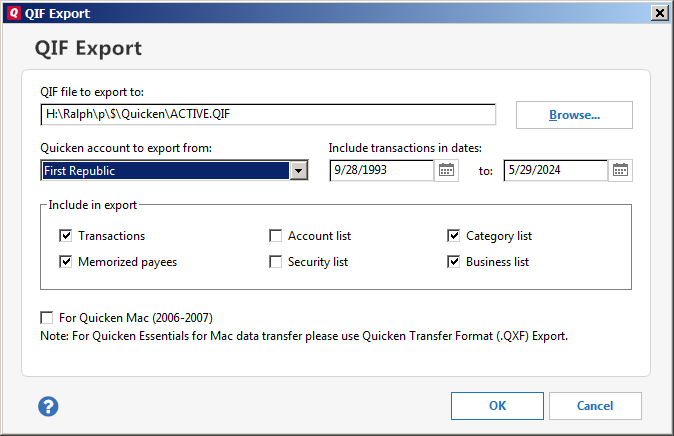

Convert CSV to QIF and import into Quicken PC 2005-2018, Quicken 2007 Mac. (.Mac account required) Expert trading:iBank now supports short and long puts and calls, stock option trading, and more.

Account for stock options in quicken for mac 2007 windows#

Quicken for Mac imports data from Quicken for Windows 2010 or newer, Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac, Banktivity. Unfortunately, Quicken 2007 will not support QIF import to bank accounts (yet. Mac account and check their performance from any web browser. Quicken for Mac 2015 or newer, Quicken for Mac 2007, Quicken Essentials for Mac. Quicken for Windows imports data from Quicken for Windows 2010 or newer, Microsoft Money 20 (for Deluxe and higher). Starting 1/22/21, youll sign in to the community with your Quicken ID. Online banking information such as account setup information, Online Payees, and online payment instructionsĬertain types of investment transactions. You can manage your subscription at your My Account page. (space) n: Add note - In an account register, select the paper clip icon for the current transaction and press the SPACEBAR then press the n key. Check this out:Īccount types that do not exist in Quicken for Mac:Įmployee Stock Purchase Plan (ESPP) transactionsĮmployee Stock Option Plan (ESOP) transactions Add follow-up flag - In an account register, select the paper clip icon for the current transaction and press the SPACEBAR then press the f key. Find many great new & used options and get the best deals for The Official Guide Ser. Intuit has listed a number of things that don't work. Quicken for Mac - Creating and Editing a Budget Quicken for Windows - Getting to know Quicken for Windows A 10.

Account for stock options in quicken for mac 2007 how to#

Find expert advice along with How To videos and articles, including instructions on how to make, cook, grow, or do almost anything. linked asset account, Quicken also tracks your current equity in the asset. Even the latest version for the Mac is poor. Learn how to do just about everything at eHow. Quicken for Mac imports data from Quicken for Windows 2010 or newer, Quicken.

Account for stock options in quicken for mac 2007 free#

So I ended up having to go back to Windows Quicken until I find something that works well on the Mac. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life. I was also granted shares similarly as RSU's in 2008, but alas my time with Intuit came up short and I never got to realize them along with a big pile of options.I bought Quicken for Mac hoping to have the same functionality that Quicken Windows had, but it would not convert a huge percentage of my Windows Quicken file, it does not offer Loan Amortization Schedules, Savings Goals, and many more features. I also future dated the "grant" as an Add Shares transaction type for each of those transactions so I knew when the vest would be occurring. Then on the same date, I put a sold transaction for the number of shares that were sold and the resulting amount showed the correct sum total of shares remaining.

For the transaction, I put a grant "add shares" transaction for 100 shares on the date of vesting. How do I enroll in Wells Fargo Business Online and Bill Pay with Quicken How far in advance should I schedule bill payments with Quicken Which accounts can. Immediately a portion of the 100 shares were sold to cover the gains and I had 53 shares posted to my account. In my example, I was given 200 RSU's in 2007 with 100 vesting in 2008 and 100 vesting in 2009. When you are vested in the transactions a portion of the RSU's are sold to cover the differences for gains. With the ones that I had, they vested 50% after 1 year and the other 50% after the 2nd year. Typically with RSU's you have a vesting period. With so many filtering options available, hitting the hourly limit is. When I had RSU's as an Intuit employee, here is how I had the transactions setup. Your account has exceeded the allowed number of bounced messages per hour and as a.

0 kommentar(er)

0 kommentar(er)